What is Education Inflation: It is defined as the steady and consistent increase in the cost of education over time.

These costs encompass a range of items including tuition fees, textbooks, school supplies, transportation, accomodations and living expenses.

These costs encompass a range of items including tuition fees, textbooks, school supplies, transportation, accomodation and living expenses.

Causes of Education Inflation:

❇️Increased demand for education.

❇️Broader economic inflation.

❇️Advancement in learning tools and infrastructure.

❇️Shifts in parental expectations.

❇️The expansion of private educational institutions.

❇️The necessity for additional coaching and exam preparations.

❇️The growing expense of studying abroad.

How will the Education Inflation Rate Impact in Coming Years in India?

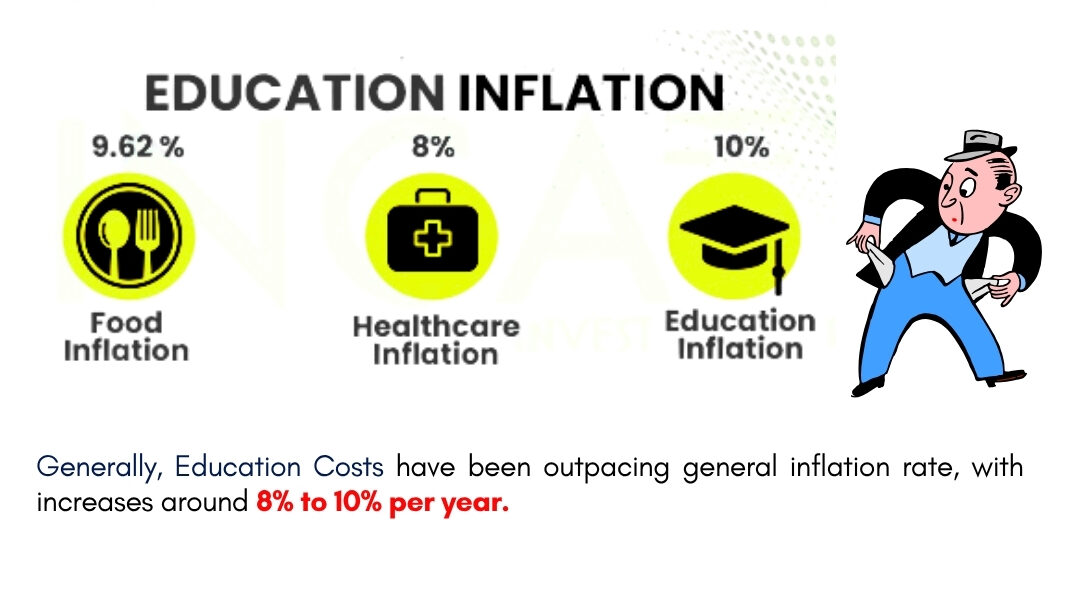

With education costs rising at 8-10% annually, the cost of education can potentially double every sex to seven years.

A Level-by-Level Breakdown for Rising Education Costs for Children in India.

1️⃣Pre primary education now costs Rs. 30,000-Rs 1,50,000 annually in urban areas.

2️⃣Primary and secondary education in private schools can range from Rs. 50,000-Rs. 3,00,000 per year, depending on the institutions.

3️⃣Higher education costs are even more daunting: engineering courses ,may require Rs. 8-15 lakhs, while medical degrees often exceed Rs. 50 lakhs.

4️⃣Studying abroad or at premier institutions like IITs and IIMs can cost Rs. 25-50 lakhs or more.

Practical Tips for Managing Rising Child Education Costs in India.

😎 Invest In SIPs and Mutual Funds: Systematic Investment Plan(SIPs) in equity or hybrid mutual funds, ideally guided by a mutual fund planner, can help you build a substantial corpus over time.

😁Insurance-Linked Plans: Child Insurance Plans combines savings and life insurance, providing financial security even in your absence.

🤩Start Early with Savings: Allocate dedicated amount of savings every month in your child’s education plan to build a substantial amount of corpus to meet child’s future higher educational expenses.

Proactive financial planning and disciplined savings-especially with guidance from a Financial Planner-can help parents stay ahead of rising education costs.

#education #inflation #risingcosts #tip #insurance #sip #equity #mutualfund #mutualfundsahihai #savings #financialplanner #lifeinsurance #parent #parentlife #childinsurance #expenses #growease #groweaseinsurance