Here’s a breakdown of the key benefits:

1. Potential for Higher Returns

-

- Mutual Funds: Especially equity or hybrid funds, can generate higher long-term returns as they benefit from stock market growth.

- Fixed Income Instruments: Returns are typically fixed and lower, and become less attractive as interest rates drop.

2. Capital Appreciation

-

- When interest rates fall, the prices of existing bonds rise (as newer issues offer lower yields).

-

- Debt mutual funds (like long-duration or gilt funds) can see NAV appreciation, giving capital gains in addition to interest income.

- Fixed income products don’t benefit from capital gains in the same way.

3. Liquidity and Flexibility

-

- Mutual Funds (especially open-ended ones) offer relatively easy liquidity, often allowing redemption within 1-2 days.

- Fixed deposits and other fixed income tools can have lock-in periods, and early withdrawals often result in penalty charges.

4. Diversification

-

- Mutual funds invest in a basket of securities, reducing exposure to the risk of any single issuer defaulting or underperforming.

- Fixed income instruments are typically concentrated, exposing the investor to more risk if the issuer defaults.

5. Inflation-Beating Potential

-

- Equity mutual funds and certain hybrid funds can outpace inflation over the long term.

- Fixed income instruments often deliver real returns (after inflation) that are very low or even negative when rates are falling.

6. Tax Efficiency (in some cases)

-

- In India, for example: Equity mutual funds attract lower capital gains tax if held long term.

- Fixed income products are taxed as regular income, which may be at a higher rate for most investors.

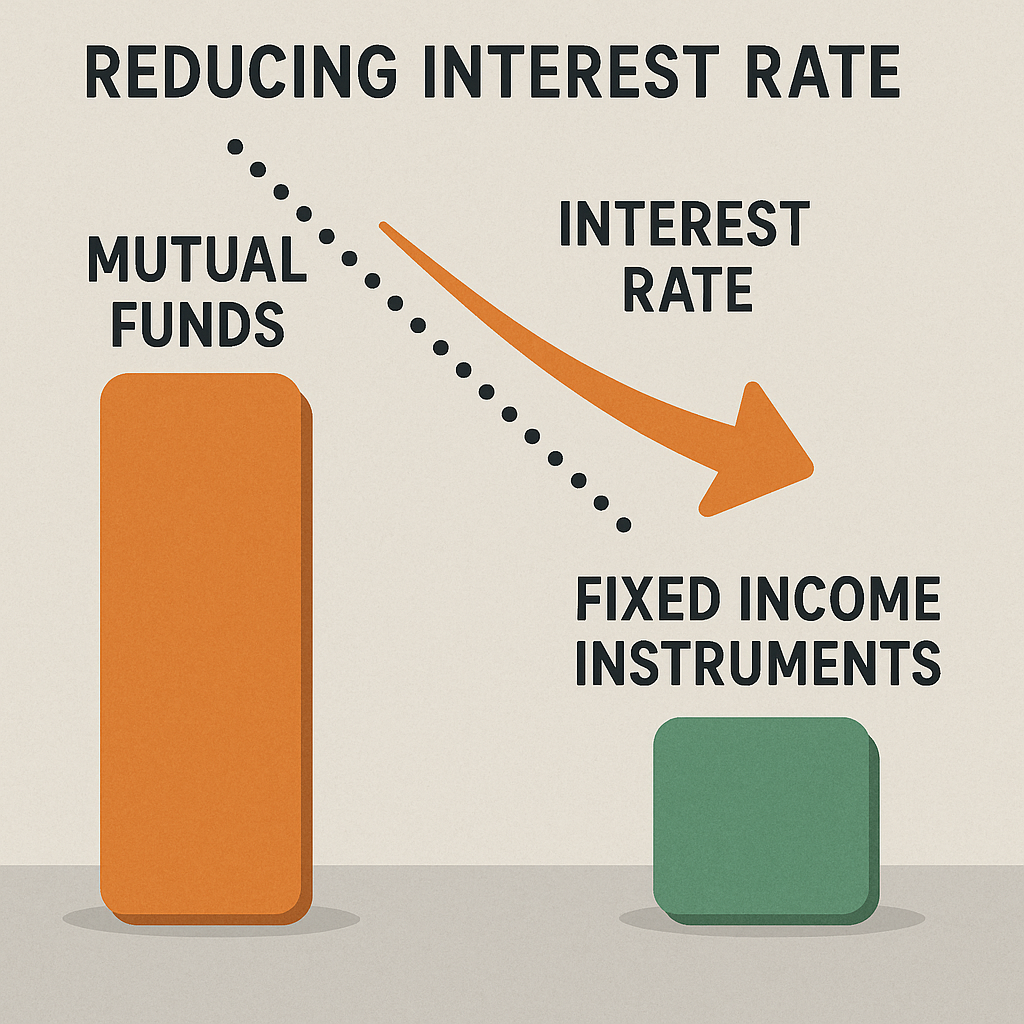

The reason appears to be that investors due to

lower rate of interest shift their investment from fixed income instruments to

market related investments like Mutual Funds, Property, Gold, etc. as they generally

give higher growth prospects in such a scenario due to enhanced investments

taking place in the economy.